Compound interest with withdrawals formula

Knowing the final ending value of the annuity is crucial for several reasons. Lump-sum or combination thereof on retirement that is predetermined by a formula based on the employees earnings history tenure of service and age rather than depending directly on individual investment returns.

Capitalize On Uninterrupted Compound Interest Wealth Nation

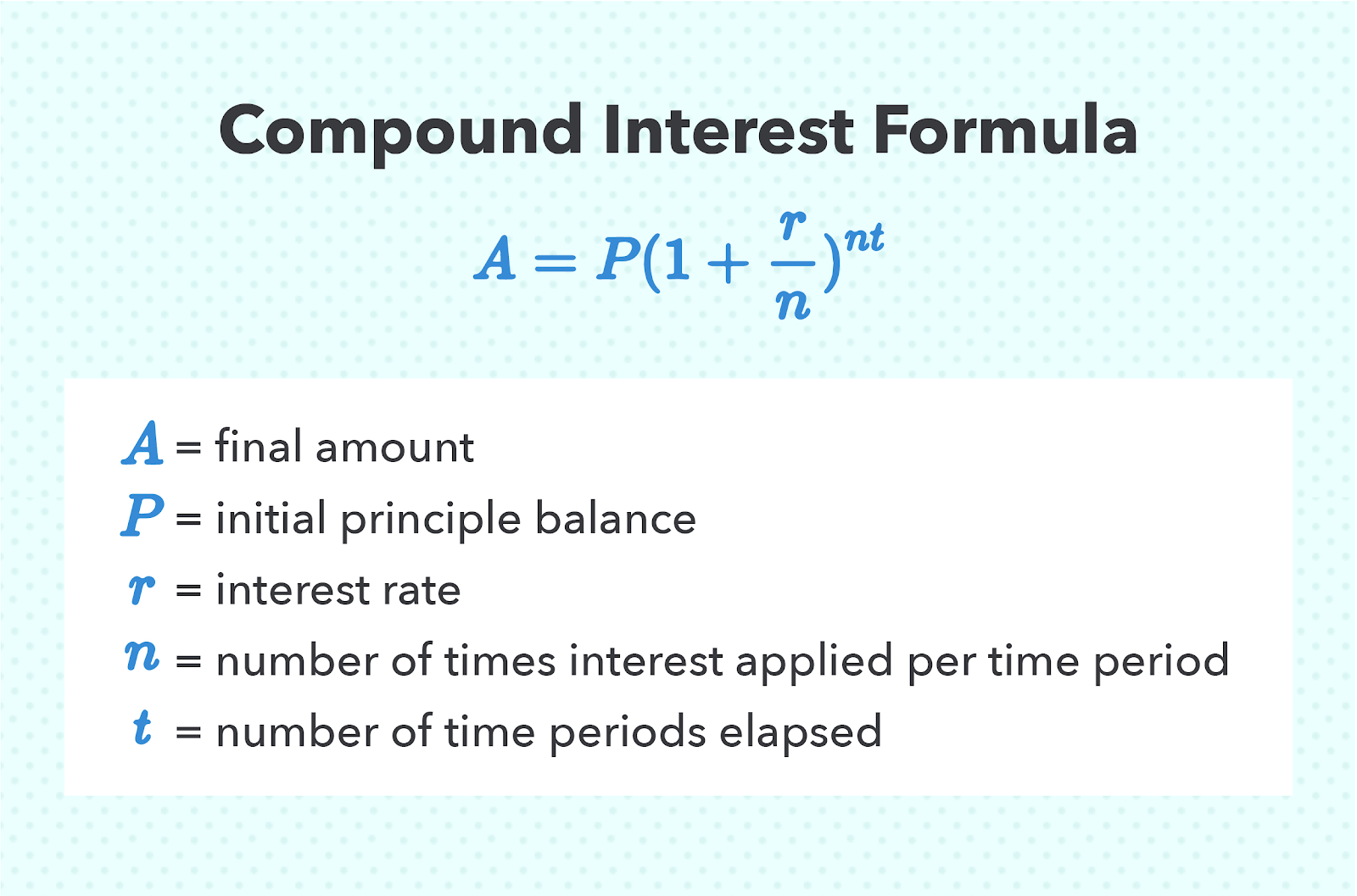

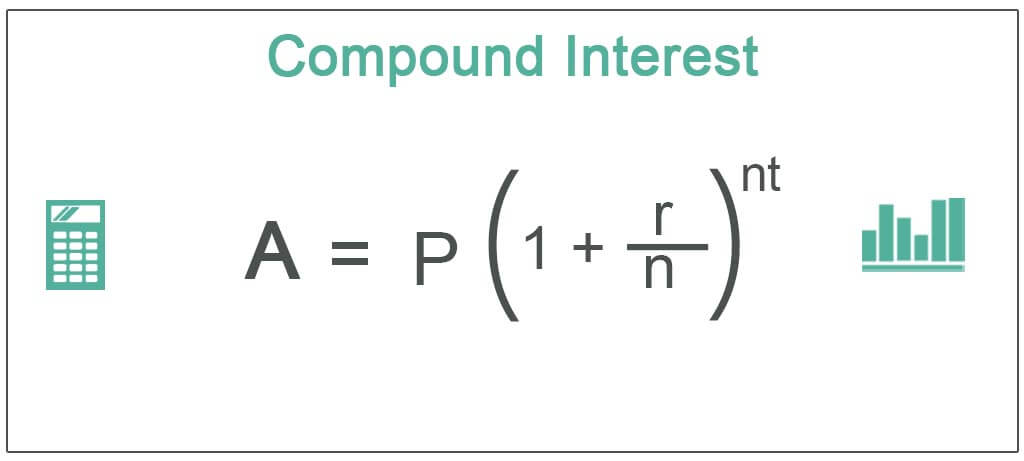

Compound interest is calculated using the compound interest formula.

. For the year the bond would have. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. The more interest you will earn over time.

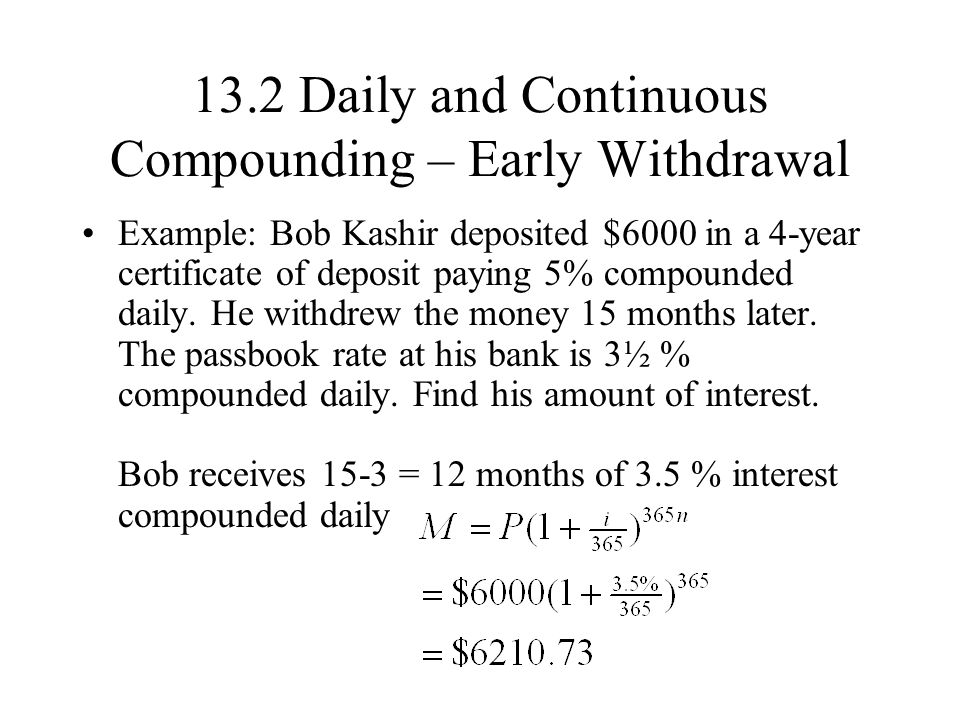

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. How to avoid early withdrawals. Compound interest is valuable for those who make deposits because it is an additional income for them the longer the deposit sits without withdrawals.

A money-weighted rate of return is a measure of the rate of return for an asset or portfolio of assets. The interest paid on this bond would be 30 per year. Although it is easier to use online daily compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution.

Lets go over the compound interest formula and define each of the variables. Bank 3 might not pay interest during a month where you take out money. The formula for compound.

With compound interest your initial deposit or principal earns interest. If the investor sells the bond after one years at a value of 1100 it will result in a 100 gain. Does PPF compound interest annually.

Future Value calculation example Let us assume a 100000 investment with a known annual interest rate of 14 from which one wants to withdraw 5000 at the end of each annual period. The compound interest formula is the way that compound interest is determined. Unlike regular FDs premature withdrawals are NOT allowed from Tax-saving FDs.

How to calculate your savings growth. They qualify as an 80 C tax-saving instrument and thus. The screenshot below demonstrates the results returned by the formula the Percentages of Total column is formatted as percentage with 2 decimal places showing.

In contrast 1929 to 1931 experienced deflation with prices falling 15. For example if you invest Rs. P1 RNNT A.

Money-Weighted Rate Of Return. Use the formula AP1rnnt where. The calculator uses the present value formula to calculate compound interest.

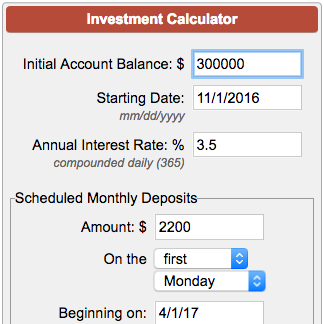

It allows you to compare the return you could receive from the annuity to other investments vehicles. When you enter an annual interest rate it calculates the future value of annuity but it can be used for monthly daily quarterly etc. Compound interest is the addition of interest to the.

Thought to have. Compound interest is a powerful force for people who want to build their savings. In other words the results of what you can achieve through the magic of.

This compounding interest calculator shows how compounding can boost your savings over time. 1000 at 9 compounded annually for 10 years your total return will be Rs. It uses the compound interest formula giving options for daily weekly monthly quarterly half yearly and yearly compoundingIf you want to know the compound interval for your savings account or investment you should be able to find out by.

Your Roth IRA contribution might be limited based on your filing status and income. 2 interest to the entire amount of your balance as long as you keep at least 1000 in your account. Parts of the total are in multiple rows.

P Principal amount the beginning balance. C p1i n - 1. Compound interest Compound interest is calculated by multiplying the principal amount of a deposit plus the accumulated interest on that amount.

The same combined contribution limit applies to all of your Roth and traditional IRAs. Compound interest includes interest earned on the interest that was previously accumulated. The money you earn in interest is added to your savings.

Compare for example a bond paying 6 percent semiannually that is coupons of 3 percent twice a year with a certificate of deposit that pays 6 percent interest once a yearThe total interest payment is 6 per 100 par value in both cases but the holder of the semiannual bond receives. Our simple savings calculator helps you project the growth and future value of your money over time. With this key job benefit your employer adds to the money you save boosting your 401k account over the long term.

It is calculated by finding the rate of return that will set. As a result retirees had to substantially increase their annual withdrawals just to maintain the same standard of living. Want to see how much you interest you can earn.

The interest on PPF is calculated on the lowest balance in the PPF account between the 5th day and the end of the month. We start with A which is your investment horizon or goal. It is valuable to lenders because it represents additional income earned on money lent.

Also it can give you a rough. A Ending amount. Traditionally many governmental and public entities.

In the above example suppose you have several rows for the same product and you want to know what part of the total is made by all orders of that. Include any regular monthly quarterly or yearly deposits or withdrawals. Heres how to compute monthly compound interest for 12 months.

Total withdrawals and final value. Limits on Roth IRA contributions based on modified AGI. The compound interest formula is A P1in.

P is the investment or principal balance at the start of. A 401k match is money your employer contributes to your 401k. You can use the results as a guide to create.

You can calculate based on daily monthly or yearly.

Retirement Formula For Annual Compound Interest With Changing Principal Personal Finance Money Stack Exchange

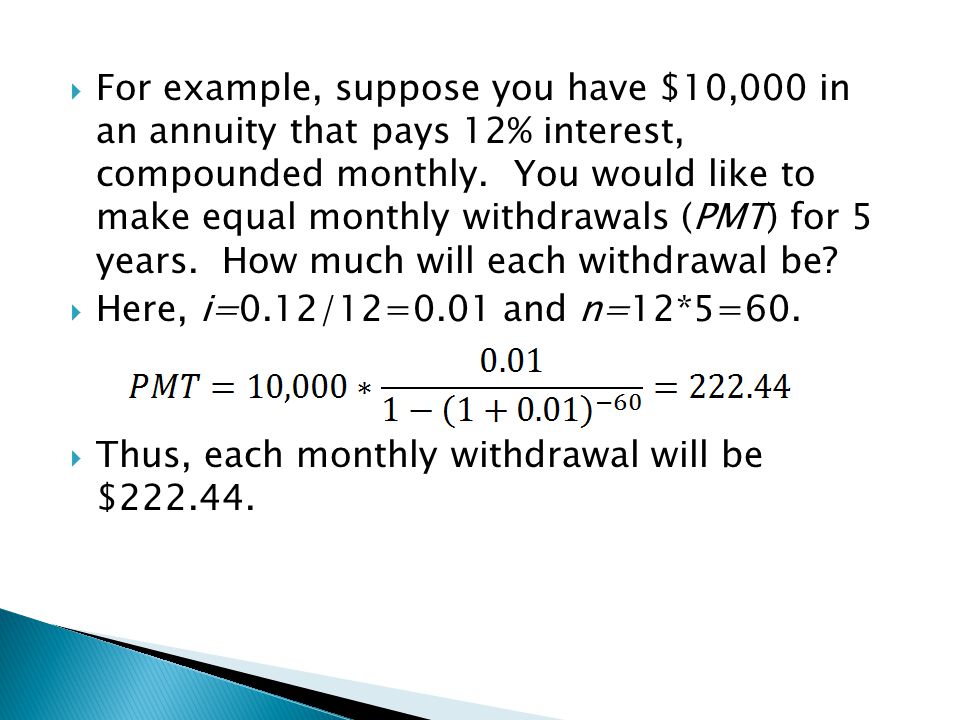

Finance Example Withdrawing From A Payout Annuity Youtube

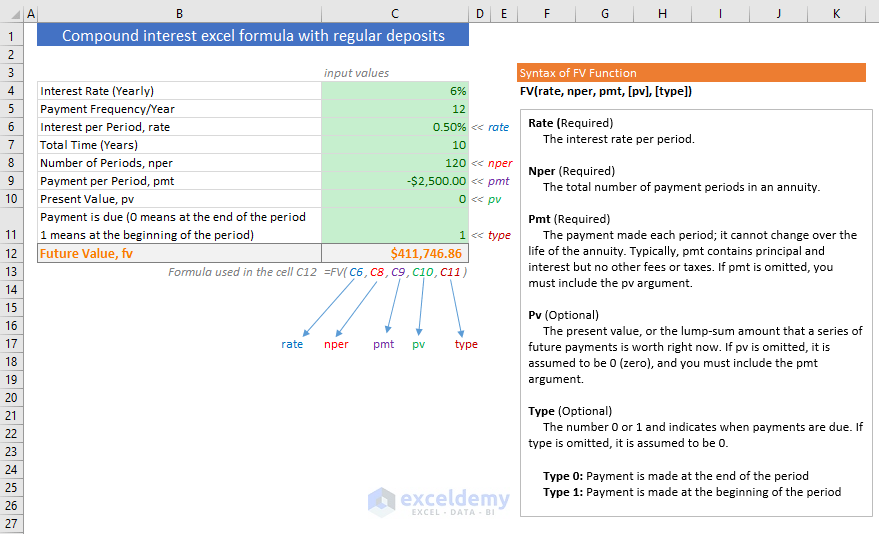

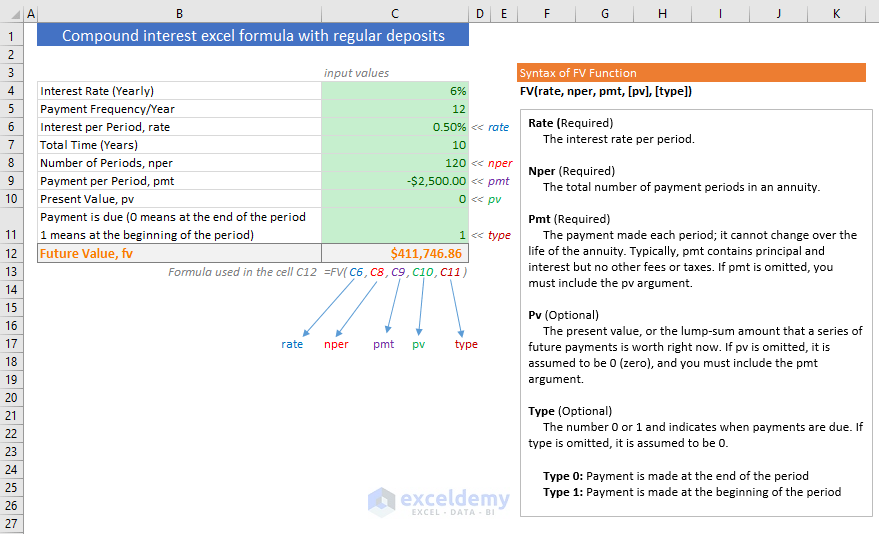

Compound Interest Excel Formula With Regular Deposits Exceldemy

Exponents And Properties Recall The Definition Of A R Where R Is A Rational Number If Then For Appropriate Values Of M And N For Example Ppt Download

401k Minimum Required Nest Egg Formula Personal Finance Money Stack Exchange

Compound Interest Example Withdrawal Case Youtube

Worksheet Function How Do I Calculate Present Value Of Irregular Deposits Withdrawals With Interest In Excel Super User

Solved Find The Periodic Withdrawals For The Annuities Given In E Chegg Com

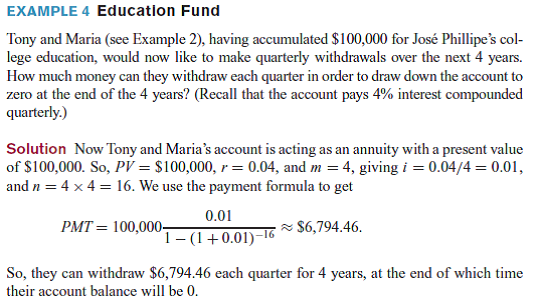

Annuities And Loans Mathematics For The Liberal Arts

Annuities And Sinking Funds Ppt Download

13 1 Compound Interest Simple Interest Interest Is Paid Only On The Principal Compound Interest Interest Is Paid On Both Principal And Interest Compounded Ppt Video Online Download

Annuities And Loans Mathematics For The Liberal Arts

3 3 Personal Finance Compound Interest Steady Withdrawal Deposits X X Ppt Download

Investment Account Calculator

3 3 Personal Finance Compound Interest Steady Withdrawal Deposits X X Ppt Download

Compound Interest Definition Formula Calculation Invest

Annuity Formula With Graph And Calculator Link